The focus will be on backing leading operators and funding prominent developers to foray into the segment, says Anshuman Magazine

India is fast becoming a digital economy with an exponential growth in data generation.

The Telecom Regulatory Authority of India (TRAI) highlights that India currently has 1.2 billion people with a unique digital identity, 637 million total Internet subscribers, with 9.1 GB data consumed per subscriber per month and 350 million smart phone devices.

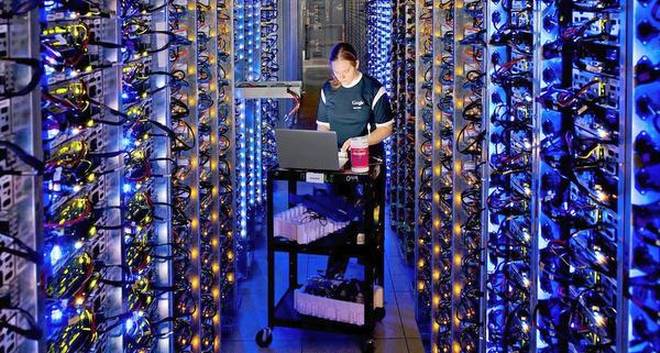

This, combined with the increased adoption of cloud computing, has created an unparalleled demand for Data Centres (DCs) in the country.

Various digitisation initiatives by the Indian government, such as Smart Cities and Digital India, have further led to a data explosion in India. This got a further boost by the rapid digital transformation of various industries such as e-commerce, telecom, financial services, online food delivery apps, and even the manufacturing sector.

The absorption rate of online gaming transactions has increased to a staggering 97%. Given these numbers, India holds enormous potential to become the ‘next destination’ for these centres.

With the ongoing COVID-19 pandemic, this projection will be realised sooner than later. Amidst the current downturn, DCs are among one of the best protected sectors. All the applications we are using to function effectively during the current crisis are ultimately powered by DCs, and therefore their role today is critical for all aspects of life.

Technology and automation provide a significant opportunity to make steep changes in terms of how DC operations evolve as we move forward in the next 3-5 years. CBRE insights highlight that their capacity is expected to grow two-fold by FY-25 from the current 500-520 MW. Major Indian cities such as Mumbai, Chennai, Bangalore, Kolkata, Hyderabad, Pune and NCR are expected to witness supply addition of upto 40% in 2020. With 41% data center capacity, Mumbai leads the data center requirements, followed by Bangalore (17%) and Delhi (16%).

Current trends

The demand for outsourced DCs has increased in India and occupiers would require flexible, scalable DC solutions that are both operationally and financially optimal.

Understanding the demand of the market, CBRE has launched Data Centre Advisory Services that enables leaders to transform their businesses with more relevant information with the least amount of effort. Our detailed analysis aids customers to leverage Data Centre & IT strategy by suggesting workload movements to the best DC/Cloud platform (depending on the application design landscape). The analysis also gives insights to systems and applications which continue to be maintained in house.

The below trends are being witnessed across the industry:

Fund deployment to rise: CBRE expects that global players will continue to take interest in investing in the country, with a focus on backing leading operators or funding prominent developers to foray into the DC segment in 2020.

Further, against the backdrop of the COVID-19 situation in India, corporates would be inclined towards investing in the cloud segment as businesses are moving online and both employees and employers prefer the work-from-home option.

Transition from captive to co-location and cloud DCs: Occupiers’ demand for co-location space over captive DCs is further likely to get a boost due to the categorisation of third-party DCs as ‘Essential Services’ ensuring uninterrupted and uneventful operations even during a pandemic situation like today. With regulatory requirements for data storage expected to be implemented in the coming quarters, corporates are now expected to re-evaluate their DC portfolios in the country.

Edge computing to become a part of DC portfolios: On the back of their ability to service precise geographic zones, cities such as Kolkata, Pune, Gurgaon, Kochi and Jaipur, particularly, are likely to be amongst the first ones to witness edge DCs in the next few years.

Sustained policy impetus to spur DC demand: The passage of policies such as the National E-commerce Policy and Personal Data Protection Bill will mandate Indian consumers’ data to reside within the country, thereby boosting the demand for DCs. Further, large-scale, nationwide initiatives such as ‘Make in India ‘, ‘Digital India’ and Smart City Mission in particular would further augment DC demand.

The expanding e-commerce segment in India will also amplify the sector’s demand as the segment increasingly needs help in managing its growing database. Along with National E-commerce Policy other measures such as the Personal Data Protection Bill, proposed policy on Data Centre Parks and digital initiatives by the government will accelerate demand.